Professional advice for your transaction

Special focus on M&A advisory in medium-sized companies

The Corporate Finance department advises entrepreneurs as a specialist for Mergers & Acquisitions (M&A) and succession planning in German medium-sized businesses. We accompany our clients through the entire transaction process until the successful conclusion of the contract.

Today I am very pleased, that I had professional support because I could have never achieved such a result on my own.

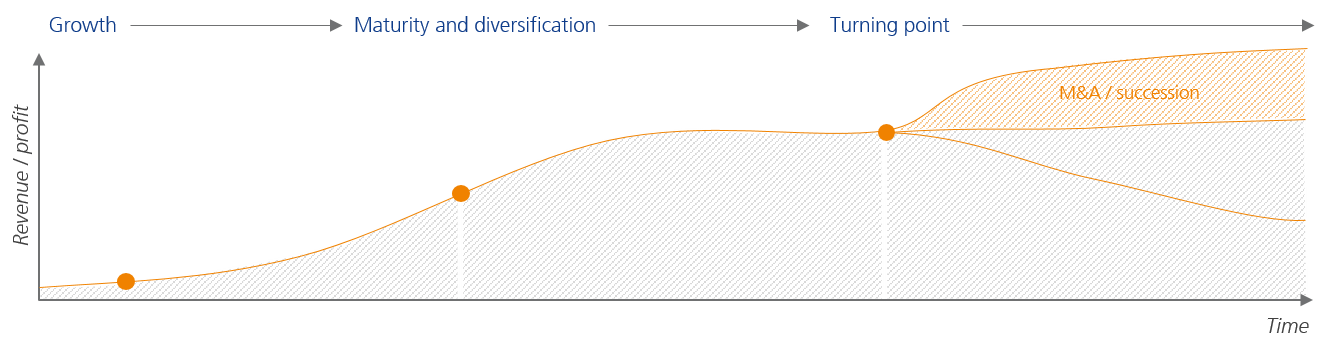

As experts for M&A and corporate finance, we advise many owner-managed companies over the entire company life cycle, from the foundation and initial phase through growth and possible internationalization to the sale of the company or company succession and/or in special situations.

Our consulting services

Finding the best owner

Would you like to arrange the succession of your company in order to withdraw more into your well-deserved private life? However, no children or family members can or want to take over your company?

We will provide you with competent and comprehensive support in the sale of your company or a part of your business to a suitable investor. Our aim is to achieve an optimal result for you and to help you achieve your personal goals.

Our work includes:

- Thorough and conscientious preparation of the process and all documents

- Confidential and professional market approach to suitable national and international investors

- Speedy execution of the due diligence

- Tough and objective support during the contract negotiations until the conclusion of the contract

With our experience from more than 200 transactions with a focus on succession solutions, we rely on thorough and conscientious preparation, confidential and professional approach of suitable national and international investors, rapid execution of the subsequent due diligence and strong support in negotiations to achieve your personal goals.

You can find an excerpt of our over 200 successful mandates here: References

For succession situations with a strong regional focus, we have a tailor-made offer for you at VR NachfolgeBeratung: to the homepage of VR NachfolgeBeratung.

We look forward to accompanying you in your plans. We would be happy to arrange a non-committal initial meeting to understand your wishes and goals.

Acquisition of a company

Do you want to grow by acquiring a company or part of a company?

- We support you in defining and implementing your acquisition targets and accompany you throughout the entire process until successful completion.

- We identify and evaluate potential acquisition targets and address them personally. Our industry expertise as well as our regional, national and international network help us to do this.

- We support you during the entire transaction as project manager and sparrings partner.

- We develop a financing strategy and contact suitable financing partners.

- We support you in the contract negotiations.

- We have proven our competence in successfully supporting our customers here, among others: references

We look forward to accompanying you in your project.

Focus on the core business

Are you considering or have already decided to divest certain activities that are not part of your core business?

No matter if business units, parts of a group, spin-off or carve-out, we manage the sales process and achieve the optimal result for you.

Find out here which clients we have already worked with successfully.

Sale of a company in a special situation

Ideally, we advise our clients to initiate a sales process from a position of strength in order to achieve an optimal price for the company. However, we know that this is not always possible. Therefore, of course, we also advise you in so-called special situations.

- You need short-term liquidity and need a financially strong partner at your side and therefore want to sell an unprofitable part of your company or even your entire business?

- You have identified certain business areas as non-core business and therefore plan to sell them?

We are there for you - in every kind of situation!

For a company there is no price tag

There is no objective price for a company. Nevertheless, our valuation specialists can determine an expected purchase price in the event of a sale using various marketable methods and provide you with decision support, even before the process begins.

In the case of an intended divestment, an excessive asking price can cause a sale to fail at an early stage. If the asking price is too low, you may lose part of the value of your life's work. A realistic price estimate is therefore indispensable.

Within the scope of a business valuation, we will work with you to develop a business plan for the coming years. By discounting the expected future earnings, we determine your company value.

And what is your company worth?

Talk to us!

Focus industries

We meet you at eye level and use our industry knowledge to your advantage. The comprehensive expertise of our experienced transaction consultants is at your disposal. Further to these focus sectors, we provide advice in numerous situations independent of their industry.

Our value added

Many years of corporate finance expertise

In total, we have experience from over 200 transactions.

We are familiar with medium-sized companies

As a member of the Volksbanken Raiffeisenbanken cooperative financial network, we are familiar with the specific needs and values of medium-sized companies.

Specialization in key industries

Our specialists meet you at eye level and use their industry knowledge to your advantage.

Regional and national network

Our network of the DZ BANK Group with its 11 specialized institutions, from over 800 Volksbanken and Raiffeisenbanken (the German cooperative banks) as well as our long-standing investor network is at your disposal.

International network

DZ BANK is a member and exclusive German partner of the ADVIOR International, an international network of M&A advisory firms specializing in medium-sized companies.

Cooperative value system

We live the cooperative values of independence, honesty and absolute loyalty to our customers.

Strong banking group with excellent rating

You benefit from the security and stability of the Genossenschaftliche FinanzGruppe (the German Cooperative Banking and Finance Group), one of the largest private financial services organizations in Germany. Learn more in the DZ BANK Group Annual Report.

.jpg/jcr%3Acontent/renditions/original.transform/resize1920/image.jpg)

%20800x450.jpg/jcr%3Acontent/renditions/original.transform/resize1920/image.jpg)